Lawmakers Blast Anthem Blue Cross Executives for Insurance Rate Hikes

House members seize on hefty compensation, lavish retreats.

Feb. 24, 2010— -- Members of the House today ripped WellPoint Inc., owner of Anthem Blue Cross, for hiking insurance premiums and blaming the rate increase on tough economic times even as the company gave executives hefty compensation and organized lavish retreats.

Earlier this month, Anthem abruptly announced it would raise premiums on more than 1 million customers in California by as much as 39 percent, more than 10 times the rate of inflation.

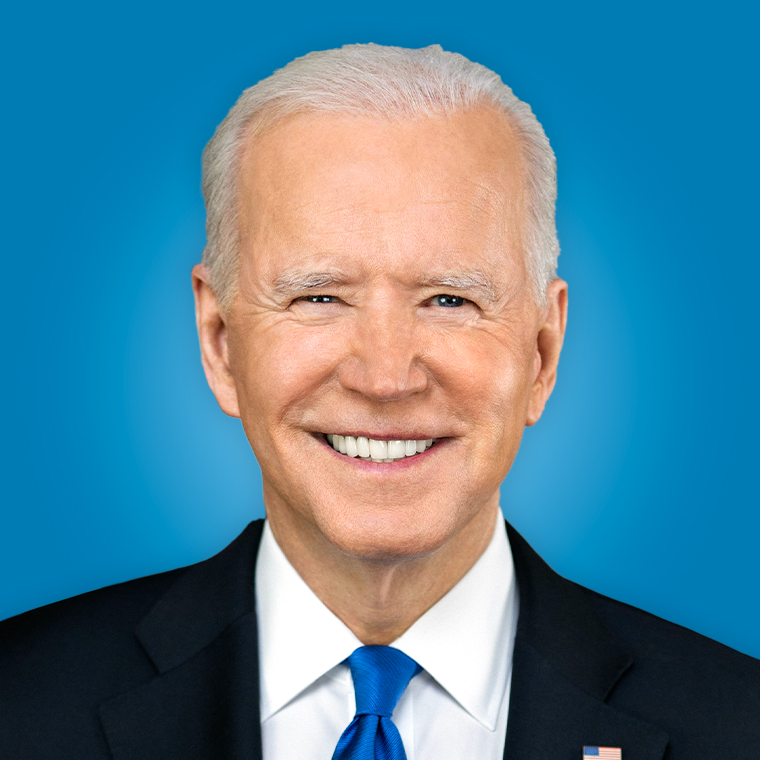

The Obama administration has assailed the state's largest insurance company for putting profits ahead of health care and demanded answers.

"Corporate executives at WellPoint are thriving, but its policyholders are paying the price," said Rep. Henry Waxman, D-Calif., chairman of the House Energy and Commerce Committee, in his opening statement.

"Health insurers like WellPoint may get richer, but our nation's health will suffer," Waxman added. "We cannot go down this road forever. It is breaking our middle class. And it will bankrupt our nation."

A study released today by the Center for American Progress Action Fund showed WellPoint, which insures more Americans than any other company, is pushing double-digit premium hikes in 11 states across the country.

WellPoint President Angela Braly blamed the economy and higher health care costs for the rate hike. She told lawmakers that the company lost $10 million on insurance for individuals in 2009, and cited increasing hospital costs as one of the reasons behind the high insurance rates.

"Less than a penny goes to health care profits. What are we going to do about the other 99 cents?" Braly said. "Insurers are among the least profitable parts of the health care system. The elephant in the room is the growth of health care spending. We are the tail on the elephant."

Lawmakers were hardly sympathetic, citing expensive corporate retreats and exorbitant salaries. Braly said she earns $1.1 million per year in addition to $8.5 million in stock compensation plus bonus. Documents obtained by the committee showed that WellPoint spent $27 million on company retreats in 2007 and 2008 at lavish resorts.

House members also accused Anthem executives of focusing on profits at the expense of their customers.

"I think a 39 percent rate increase at a time when people, Americans, are losing their jobs, losing their health care is so incredibly audacious, so irresponsible," said Rep. Jan Schakowsky, D-Ill.

WellPoint's profits last year totaled $4.2 billion. Braley said the profit was the result of an asset sale.

The company said its profit margin of about five percent is reasonable and relatively low, compared to the rest of the health care sector. WellPoint's profit margin was considerably lower than pharmaceutical firms, biotech firms and about the same as community hospitals.

Some customers say the insurance premium hike makes it virtually impossible for them to afford coverage.

Julie Henrickson, a self-employed mother of two, got a letter from WellPoint saying her premium this year was going to go up by $310 a month.

"If I were to accept this new monthly premium of $1,352, thereby retaining my same current policy, this amount would be shy just $92 of my monthly home mortgage payment," Henrickson told lawmakers. "In this economically depressed environment, I find the fact of Anthem Blue Cross raising premium costs to individual policy holders by such high amounts truly unconscionable."

"If Anthem goes ahead with its desired rate increases," Anthem customer Jeremy Arnold of Los Angeles told lawmakers, "I will almost certainly be driven to a high-deductible policy and will have to hope that I don't get sick or injured. Hope is not an adequate health care policy."

Another customer Lauren Meister of West Hollywood, Calif., said all she's looking for is affordable insurance.

"I don't want to spend the next 15 years of my life looking forward to being 65 so I can get Medicare," Meister said.