What to Know About the Anticipated Increase in Interest Rates

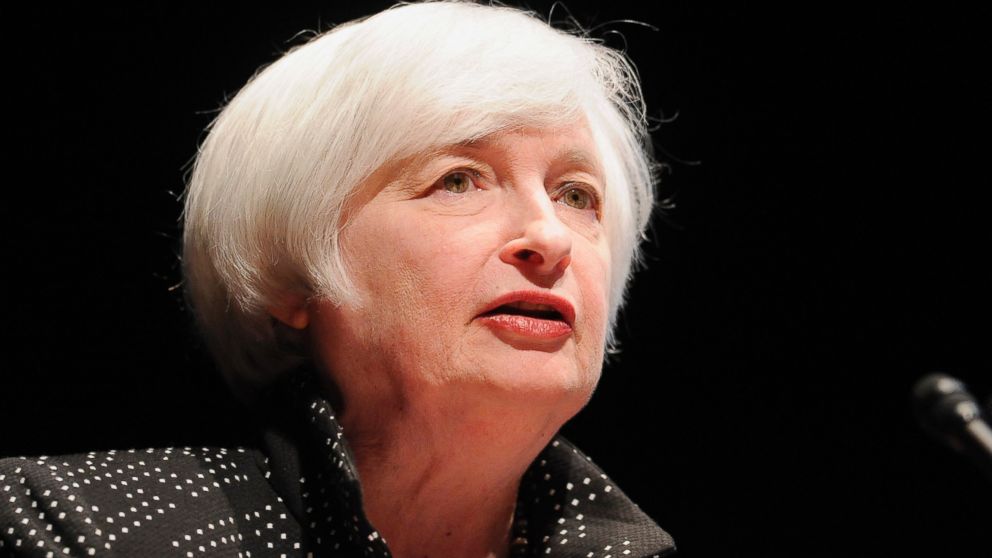

Federal Reserve chair Janet Yellen finally said a change is coming.

— -- Federal Reserve chairwoman finally laid some jitters of investors to rest when she said that interest rates are likely to rise later this year, which can affect everything from your savings to credit card fees.

The Federal Reserve has kept short-term interest rates near zero since 2008, so many people expected the Fed to raise rates this fall. But so far, citing lackluster inflation and concerns about global growth, the Fed has so far hasn't touched rates.

But Thursday, in a speech at the University of Massachusetts at Amherst, Yellen said and her colleagues "anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year and to continue boosting short-term rates at a gradual pace thereafter as the labor market improves further and inflation moves back to our 2 percent objective."

Raising the federal funds rate increases borrowing costs for banks, which may affect their services to consumers. Here's what you should know about how the anticipated increase will affect your wallet:

1. The increase will be gradual.

If the Federal Reserve does raise interest rates, it will only be by a fraction of a percentage point. The last time the Fed raised the federal funds rate was June 29, 2006, and that was by a quarter point to 5.25 percent.

2. Bank fees may rise

While interest rates remain near zero, bank fees may remain low and credit card issuers may continue to offer zero-percent balance transfers, according to Bankrate.com chief financial analyst Greg McBride.

3. Should you buy a home or re-finance?

Mortgage rates are low by historical standards, having remained below four percent for nine straight weeks. Yesterday, Freddie Mac reported that the interest rate on 30-year fixed rate mortgages dropped by 5 basis points to 3.86 percent. Last year, it was 4.2 percent.

Potential homeowners shouldn't necessarily rush to buy a house before any increase in interest rates, especially if it's not in your budget, but homeowners with adjustable rate mortgages and home equity lines of credit should be mindful that the cumulative effect of interest rate hikes over the course of the next couple of years could have a dramatic effect, McBride said.

McBride's advice to homeowners has been to refinance into a fixed-rate mortgage now, or check if your home equity lender is among those that offers fixing the interest rate on the outstanding balance of your home equity line.

4. How you save may change.

The return on your money in the bank may increase, but don't hold your breath. Banks may take their time in sharing some of their profits with you.

5. Getting a car loan can get pricier.

Borrowing for loans in general for banks and consumers, such as auto loans, will likely rise after the federal funds rate, though the timeline when that will be noticeable is anyone's guess.