Fed Won't Ease Off Economic Stimulus Program

Investors expected the Fed to Announce a Curtailment of its Bond-Buying

Sept. 18, 2013 — -- The Federal Reserve today declined to curtail its economic stimulus program, surprising investors who had expected the government's bond-buying to be tapered off starting this month.

Investors anticipated that the policy statement at the end of the two-day Federal Open Market Committe meeting today would lead to a "tapering" announcement of the Federal Reserve's $85 billion a month bond purchase program. The question was how much the Federal Reserve would scale back its purchases. Many investors on Wall Street expected the Federal Reserve to cut its purchases by about $10 billion to $15 billion. Instead, it did nothing. Stocks moved sharply higher on the news.

"Today's moment of truth, at which the FOMC was widely expected to announce its first reduction in the pace of quantitative easing—and therefore the turning point in a five year old monetary policy regime—has fallen flat," said Guy LeBas, chief fixed income strategist with Janney Capital Markets, in a research note. "Instead, what we have from the central bank is just one more brick in the carefully-laid wall of shifting monetary policy...Bernanke simply isn't willing to give up. Not yet, at least. That will have to wait for November."

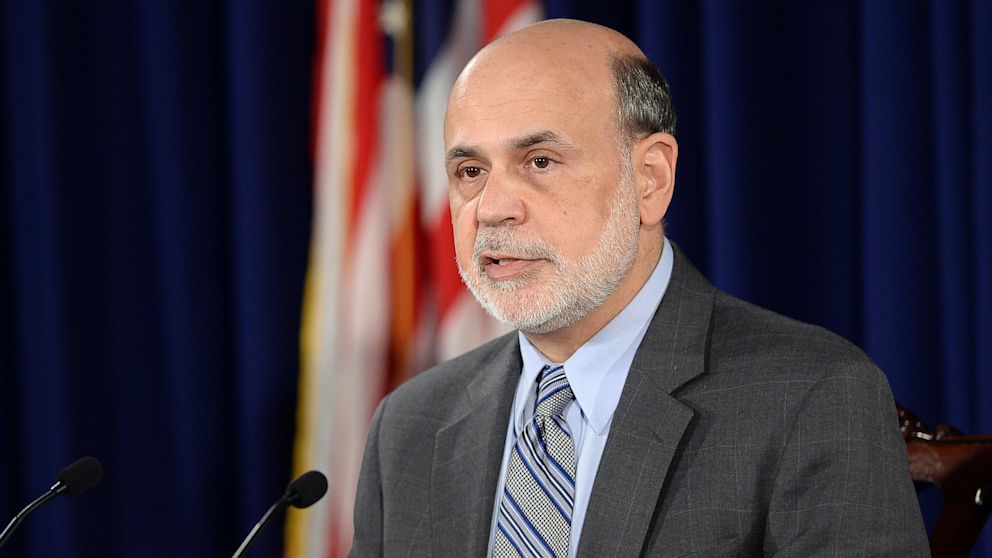

Federal Reserve Chairman Ben Bernanke will go in front of cameras for his quarterly news conference at 2:30 p.m. ET.

"Taking into account the extent of federal fiscal retrenchment, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy," the Fed said in a statement. "However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month."

In the spring, markets tumbled after Bernanke said the Federal Reserve would consider reducing purchases in light of improving economic data, such as employment figures. The Fed's bond purchases since the 2007-2008 recession have flooded the economy with cash, spurring lending and keeping interest rates low.

The Fed has said in previous policy statements that it would keep the federal funds rate, the rate at which banks lend to each other overnight, at zero to one quarter percent while the unemployment rate remains above 6.5 percent and inflation remains in line with expectations.

The unemployment rate is 7.3 percent, according to the Labor Department's most recent jobs report for August.

Read More: What People Are Saying About the Federal Reserve Chair Candidates

While the effect of Wednesday's news on interest rates and stock prices was positive, "the signal for the real economy was not good," said Brad McMillan, chief investment officer for Commonwealth Financial.

"For the Fed to maintain the current level of stimulus suggests that they think the real economy is weaker than is widely supposed," he said. "If that is the case, then employment and spending may increase less in the next several months than most people now expect."