Charges Against Stanford a Long Time Coming, Offshore Banking Experts Say

Accused Financier Under Federal Drug Investigation

By JUSTIN ROOD and BRIAN ROSS

February 19, 2009—

Offshore banking experts say that the fraud charges this week against accused financial scammer R. Allen Stanford have been a long time coming.

"There's no surprise at all," said Washington lawyer and IRS consultant Jack Blum. "This man has been on law enforcement's radar screen for the better part of 10 years."

But the SEC didn't move forward until this week, after two former Stanford Financial whistleblowers filed an alleged lawsuit, which revealed how the bank lied about too-good-to-be-true certificates of deposit.

"The problem was the published returns that many advisors use to present to clients and prospects," said former Stanford Group employee Mark Tidwell, "that now we knew that information was incorrect."

"They would lie about it and that behavior just became more and more prevalent," said Charles Well, the other former Stanford Group employee.

But now the SEC's fraud charges may be the least of Stanford's worries. Federal authorities tell ABC News that the FBI and others have been investigating whether Stanford was involved in laundering drug money for Mexico's notorious Gulf Cartel.

Authorities tell ABC News that as part of the investigation, which has been ongoing since last year, Mexican authorities detained one of Stanford's private planes. According to officials, checks found inside the plane were believed to be connected to the Gulf cartel, reputed to be Mexico's most violent gang. Authorities say Stanford could potentially face criminal charges of money laundering and bribery of foreign officials.

Authorities say the SEC action against Stanford Tuesday may have complicated the federal drug investigation. The SEC had been prepared to move in earlier, but was asked to hold off because of the FBI's undercover investigation. But this week, when officials realized Stanford was moving huge amounts of cash out of his bank, they had no choice to move in, even if it jeopardized the drug money case.

The federal investigation, however, did not stop Stanford from using corporate money to become a big man at last year's Democratic convention in Denver.

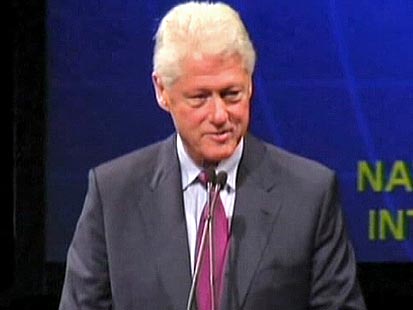

A video posted on the firm's web-site shows Stanford, now sought by U.S. Marshals, being hugged by Speaker of the House Nancy Pelosi and praised by former President Bill Clinton for helping to finance a convention-related forum and party put on by the National Democratic Institute.

"I would like to thank the Stanford Financial Group for helping to underwrite this," Clinton said to the crowd at the event.

Stanford Financial was listed as the "lead benefactor" for the gathering, and Stanford was permitted to address the audience of several hundred.

Stanford contributed $150,000 to underwrite the event, said NDI president Kenneth Wollack. More recently, Stanford gave $5,000 to help pay for a luncheon hosted by the group. At the time NDI had no idea of Stanford's trouble, and it is has not had any contact with him since the December event, said Wollack.

"We had no reason to believe that a very public company that was also engaged in philanthropic work might be suspect," said a spokesperson for the National Democratic Institute, Amy Dudley.

The SEC charged yesterday that Stanford was running a fraudulent investment scheme that may have bilked customers out of as much as $8 billion.

Stanford's whereabouts are unknown and U.S. Marshals say they are searching for him.

Over the last decade, Stanford has spent more than $7 million on lobbyists and campaign contributions to Washington politics in both parties, although the vast majority of the money has gone to Democrats.

Donations to Democrats Outweigh those to Republicans

A total of $1.56 million was given to Democrats, according to OpenSecrets.org. Republicans received $840,000. Stanford also hired big-name lobby firms like DLA Piper and Parry, Romani and DeConcini.

Following a Good Morning America report by Brian Ross on Wednesday, many embarrassed members of Congress who received Stanford contributions tried to distance themselves from the scandal and vowed to turn the money over to charity.

Sen. Bill Nelson (D-FL) was the single biggest recipient of Stanford contributions, according to the Center for Responsive Politics. He received $47,000 from Stanford.

"I've instructed my staff to return every Penny," Nelson said Wednesday. Any donations from Stanford or his employees with be given to charity, he said.

Arizona Republican Senator John McCain got $28,000, while New York Democratic Senator Chuck Schumer got $17,000. Both said they would give the money to charity.

Where is Stanford?

Federal authorities say they do not know the current whereabouts of the Texas financier, who is accused of cheating 50,000 customers out of $8 billion dollars. His financial empire in Houston, Memphis, and Tupelo, Miss., were raided Tuesday.

The Securities Exchange Commission alleges Stanford ran a fraud promising investors impossible returns, much like Bernard Madoff's $50 billion alleged Ponzi scheme.

Investigators Tuesday shut down and froze the assets of three of the companies Stanford controls and they say the case could grow to be as big as the Madoff scandal. Like Madoff's clients, Stanford's investors are in shock.

"Initially we put our money in this institution and in a CD because we were nervous about the markets and thought it was a safe place," said investor Brett Zagone. "I'm so upset right now I can't even talk about it."