Citizen watchdogs eye Congress' 'killing it' approach to stock trading

Lawmakers could vote for infrastructure bill, then buy stock in a concrete firm.

Chris Josephs wakes up each morning, opens his laptop, and combs through last night’s stock trades.

Josephs, who lives in Santa Monica, California, is not keeping an eye on his own portfolio. Instead, the 20-something tech entrepreneur has spent years intensely following the stocks that are bought and sold by people on the other side of the country -- members of the United States Congress.

“It all started off as infuriating,” he said. “You're like, ‘what the, wait, how are they allowed to do it when other Americans can’t?’”

As long as a trade is reported within 45 days, there’s no law preventing members of the House or Senate from trading stocks, even if the bills they pass or committees they sit on could influence a company’s stock price.

Outraged at first, Josephs says he decided to get in on the action. He moved out West and with a handful of friends launched the app Autopilot.

Autopilot allows users to follow a politician's trades and then copy them, automatically buying or selling that same stock a lawmaker does at whatever dollar amount they’d like. After less than a year, the company says it has users dedicating tens of millions of dollars to copy the trades certain politicians make.

“The reason why we initially set out with the politicians is because they were killing it,” Josephs told ABC News. “They were making a lot of money.”

In 2012, President Barack Obama signed the STOCK Act, banning members of Congress from trading with nonpublic information, meaning details they glean in their work that are not available to the general public.

But members can still trade. For example, a hypothetical lawmaker could vote for an infrastructure bill and then buy stock in a concrete company. Or they could sit on the Armed Services Committee and legally trade in the stock of defense contractors that receive sizable government contracts.

Josephs is part of a growing online community that’s begun posting on social media the trades members of Congress make, in an effort to show the American people what winners and losers lawmakers pick.

The most well-known name in that movement is the account Unusual Whales. The person behind the account spoke with ABC News [but asked that his name not be used], disguising his face and voice out of fear of blowback from the politicians whose trades he dissects and then publishes on his website and social media accounts that have gained millions of followers.

“One thing people always say is that members are very good at picking stocks, that's often assumed…but to be quite frank, members were also quite good at avoiding losses,” he told ABC News in his first television interview.

He pointed ABC News to the collapse of Silicon Valley Bank (SVB) and the regional banking crisis. He tracked trades showing several members of Congress, who sit on the House and Senate committees that regulate the financial industry, who sold SVB and other bank stocks before they experienced their sharpest decline.

“I can't know the intent, if that was what they were aiming to do,” he told ABC News. “But many of the members who were trading banking stocks during that time performed very, very well.”

Annual reviews of the trades of 535 members of the House and Senate, compiled by the Unusual Whales account, have found lawmakers' stock portfolios consistently beat the S&P 500.

Several members of Congress who actively trade stocks and spoke with ABC News, but declined to be identified, said they never trade with nonpublic information. Some said their trades are made through financial advisers and often without their knowledge. Others said that trading stocks shouldn’t be banned because doing so would cut off a financial source that some politicians use to supplement their income.

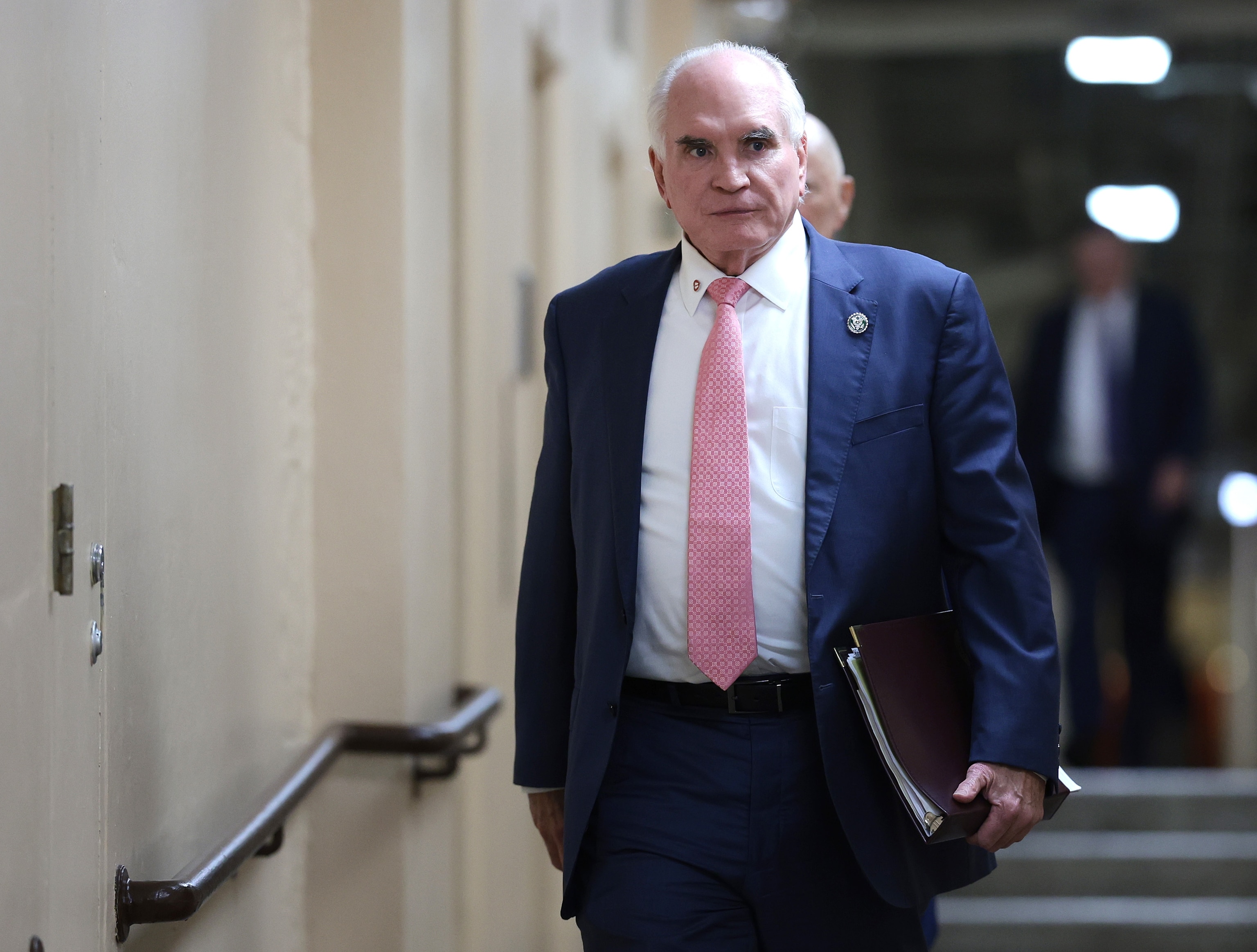

ABC News found one trade, made by Victoria Kelly, the wife of Rep. Mike Kelly, R-Pa., which has been under investigation by the House Ethics Committee for more than two years.

A report by the Office of Congressional Ethics (OCE) alleges, in 2020, Victoria Kelly purchased between $15,000 and $50,000 worth of stock in Pennsylvania steel producer Cleveland-Cliffs Inc. She did that, the OCE alleges, after her husband, the congressman, learned the Trump Commerce Department had agreed to open a probe into foreign competitors of the company, which would have impacted the company’s stock price.

But according to investigators, Victoria Kelly bought the stock before that move was made public. The report alleges there is “substantial reason to believe” that stock was purchased with “confidential information.”

Lawyers for the congressman say there’s no evidence the congressman had “any involvement whatsoever in Mrs. Kelly’s decision” to buy the stock and the congressman’s office has said the purchase was Victoria Kelly’s attempt to “show her support” for the struggling company.

The ethics committee opened an investigation into the trade in October 2021. It is ongoing.

When asked by ABC News about the allegations, Rep. Kelly said he was “not going to comment,” citing the pending investigation.

ABC News also found other members of Congress whose trades are under scrutiny, like former Speaker of the House Nancy Pelosi, D-Calif., who has reported millions of dollars in trades over the years, many made by her husband, a financier.

Chris Josephs estimates roughly $10 million in user money on his app Autopilot is specifically dedicated to copying the trades Pelosi discloses on official congressional forms.

In a statement, Pelosi’s office told ABC News she has “no prior knowledge or subsequent involvement in any transactions made by her husband” and was “fully supportive” of Democrat-led efforts last year to ban congressional stock trading.

But those efforts failed. And now there are renewed calls to ban members of Congress from trading stocks altogether.

Earlier this month, Rep. Abigail Spanberger, D-Va., who has long championed a bill to ban her colleagues from trading stocks, called on Speaker Mike Johnson to take action on the issue.

There is also a similar bill backed by Rep. Matt Gaetz, R-Fla., a hardline House conservative, and Rep. Alexandria Ocasio-Cortez, D-N.Y., a fervent progressive.

“We have access to sensitive information,” Ocasio-Cortez told ABC News. “And to think that a [member of Congress] could then purchase individual stock and make bets and trades and personally benefit from that is, I think, in direct conflict with the spirit of public service that we're here to do.”

Then, there’s the bipartisan duo from Colorado of Rep. Ken Buck, a Republican, and Rep. Joe Neguse, a Democrat, who, with 19 other Republicans and Democrats, signed a letter in May pushing congressional leaders to do something about stock trading.

“[Congressional stock trading] appears to be unethical, and it is wrong fundamentally and American people know it’s wrong,” Buck told ABC News in a rare joint interview, alongside Neguse.

“The American people expect members of Congress to be serving the American people. And the American public. And not their stock portfolios,” Neguse added.

But, despite public pressure, all the proposed bills to ban congressional stock trading have stalled in various House and Senate committees.

“Welcome to Congress,” Buck replied when asked by ABC News about the lack of progress.

“It has taken longer than we certainly would have liked, but we're going to continue to push forward,” Neguse added, saying he remains optimistic. “More and more members have joined in this effort than perhaps ever before.”

Chris Josephs is less optimistic.

“I don't think they'll ban it. I think it's all a smokescreen. I genuinely don't think they'll do it, because it doesn't benefit them,” he said before turning to his laptop to watch the trades come through.