What Jeb Bush's Tax Plan Might Mean for You

We break down the Republican candidate's tax plan into ordinary language.

GARNER, N.C.— -- Of all the topics U.S. voters have to understand, none is more complicated than taxes. Think 80,000 pages of convoluted code, abstract loopholes and what seems like innumerable exemptions.

Confused yet?

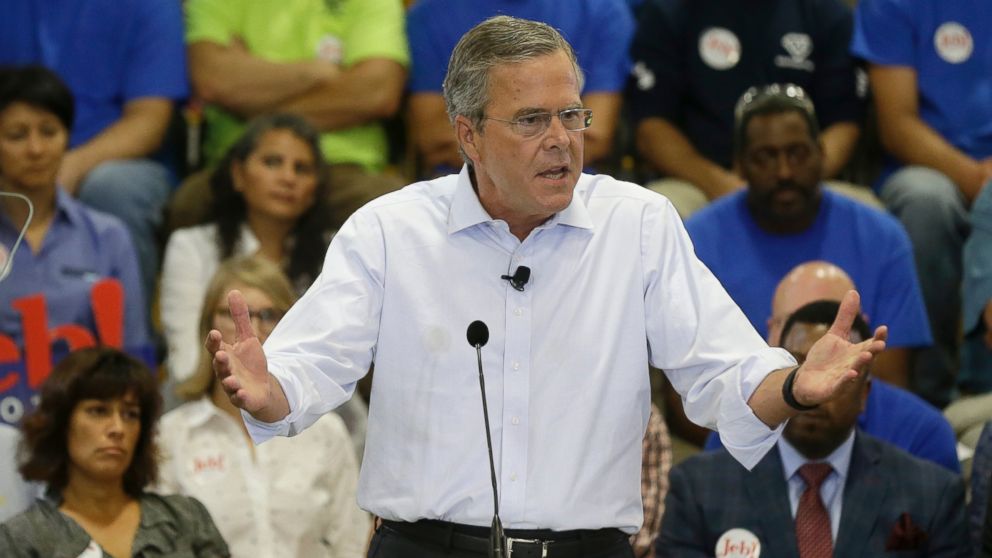

Republican presidential candidate Jeb Bush said he wants to change all that.

“Of all the terrible things that can be said about our tax code – and I can think of a few – the worst is probably this: It punishes people for doing things we should encourage and rewards people for doing things that may not be so good. It taxes paychecks hard but gives companies a write-off for debt,” Bush said Wednesday in North Carolina. "I believe it’s time we build for the future, not borrow from it.”

In short, he plans to simplify the tax code, making it so that ordinary people can understand and file their own taxes. So what would this mean for you? We asked these two economists to help us figure it out:

Kevin Hassett: director of economic policy studies, the American Enterprise Institute, served as a policy consultant to the U.S. Treasury under Presidents George W. Bush and Bill Clinton.

Harry Stein: director, fiscal policy, the Center for American Progress

"It's a really big proposal; kind of thing that a president pushes in the first State of the Union. It has a million bells and whistles," Hassett said, adding, "It's the kind of impressive tax plan that you usually don't see."

1. Reducing Tax Brackets:

Bush’s big goal is to do what President Reagan did: lower tax rates. In his policy plan, instead of seven brackets, there are now three: 28 percent, 25 percent and 10 percent. Bush noted in an op-ed in the Wall Street Journal that "at 28 percent, the highest tax bracket would return to where it was when President Ronald Reagan signed into law his monumental and successful 1986 tax reform.”

QUESTION: Aren't these just more tax cuts for the wealthy?

Hassett: That will undoubtedly benefit people in upper brackets more. One of the things we've seen is a collapse in the role of small business in the economy ... this is the policy that has the potential to have the biggest positive effect.

Stein: Bush's tax plan would give huge tax cuts to the wealthiest Americans. It cuts taxes on investment income, which overwhelmingly benefits the wealthy (since they are the ones with wealth to invest).

2. Eliminating Penalties and Other Taxes

Bush’s plan also eliminates certain taxes to double the standard deduction now taken by roughly two-thirds of all filers. He would cut the marriage penalty, which causes some married couples to pay higher taxes than they would if they were single.

It also expands the Earned Income Tax Credit, ends the death tax, which requires a person's estate to be taxed, retires the Alternative Minimum Tax and ends the employee’s share of the Social Security tax on earnings for workers older than 67.

Bush says that, under his plan, 15 million Americans would no longer bear any income-tax liability. Families of four, with an income less than $40,000 a year would no longer pay any income taxes.

QUESTION: So what does that mean for the ordinary taxpayer? Will most people see their taxes go down?

Hassett: The rate reduction means, for people who are trying to decide to work an extra hour or get another job, wherever you are in the tax code, under the Bush plan you get to keep more of the money you earn. Through an increase in the standard deduction, it makes a lot of people not go into taxable status.

I think that it's probably the case that just about everyone's taxes would go down. It's not a revenue neutral proposal. Here they're cutting it for everyone. The rich guy's taxes are going down but the poor guy's are, too.

Stein: For ordinary taxpayers, some will get tax cuts but others might get tax increases. For taxpayers who itemize, including some middle-class taxpayers, the reductions in itemized deductions might outweigh the other effects of the plan and cause their tax bills to go up.