Homebuyers need more than falling mortgage rates to jump back into the market

A decline in mortgage rates convinced some homebuyers to come off the sidelines.

A recent decline in mortgage rates has convinced some homebuyers to come off the sidelines. But other factors may keep buyers out of the market.

Mortgage applications are up 28% from early November, and the number of people contacting real-estate agents to start the buying process has rebounded from a November low, according to brokerage Redfin.

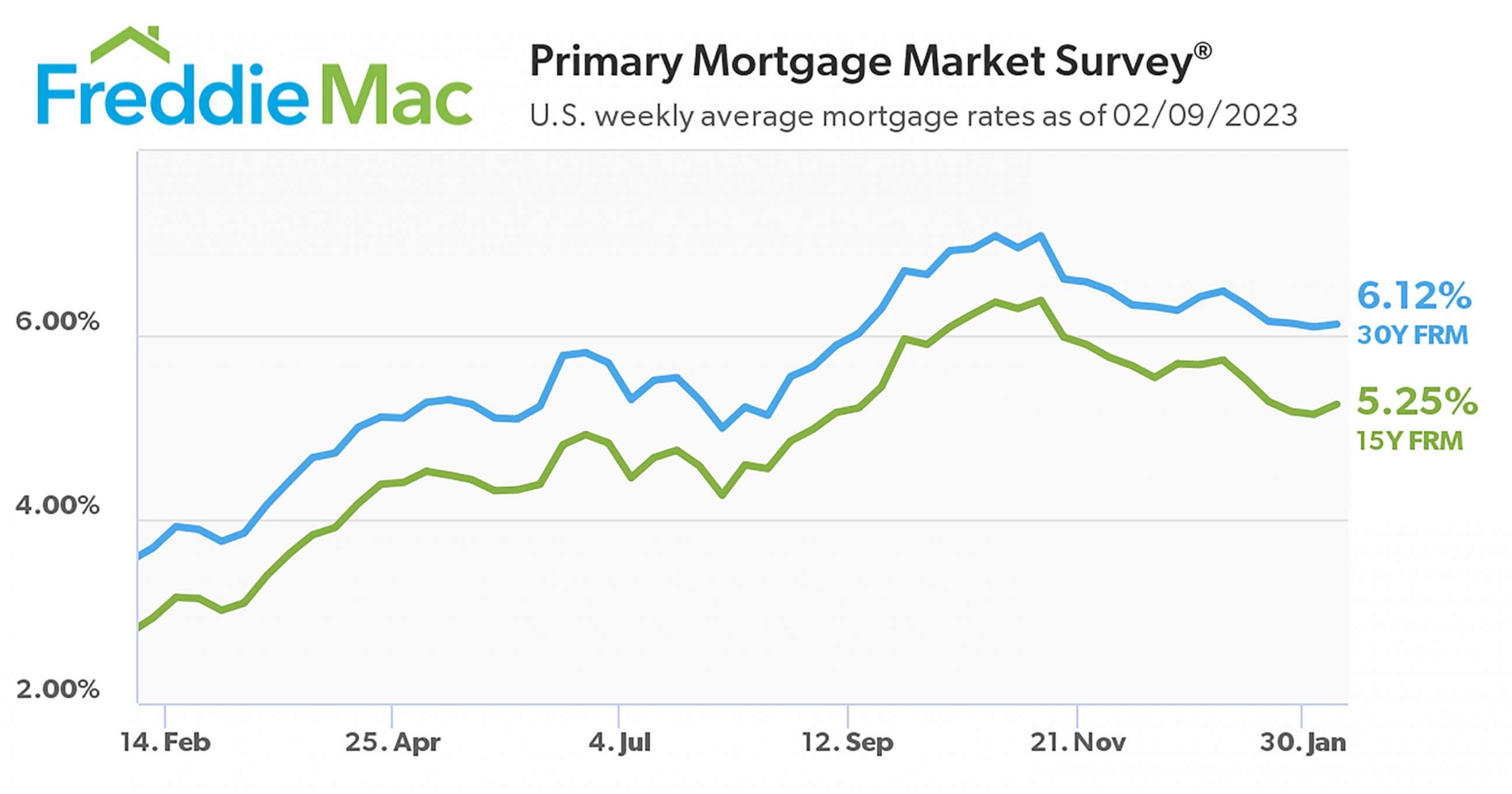

At the same time, the average rate on a 30-year-fixed-rate mortgage has declined to 6.12% from its October peak of 7.37%. Still, that is nearly double from a year ago, when the rate was 3.69%, according to mortgage finance giant Freddie Mac.

"I've seen more homes go under contract this month than in the entire fourth quarter. Listings that were stagnant in November and December are suddenly getting one to two offers," said Redfin agent Angela Lagone of San Jose, California.

The more than full percentage point drop in mortgage rates over the past several months has translated into significant savings for potential homebuyers. A consumer purchasing a $400,000 home today with a 20% down payment will have a monthly mortgage payment that is roughly $290 less than they would have paid in October.

Now that mortgage rates are down from their peak, Langone said sellers are more willing to negotiate. "Some buyers are having luck winning a home for under asking price, especially if it has been on the market for several weeks, but those days may be numbered," she said.

Of course, mortgage rates are only part of the equation. A home's price can just as easily push a buyer out of the market.

The median listing price in January was $400,000, according to Realtor.com, roughly 8.1% higher than a year ago, but still lower than June's peak of $449,000. Just 42% of new and existing homes for sale in January were considered affordable for the typical U.S. household, according to Robert Dietz, chief economist at the National Association of Home Builders.

Even though homebuyer demand is improving, the number of available homes for sale is still very low, and that is keeping upward pressure on prices. At the end of December, total housing inventory was below one million at 970,000, down 13.4% from November with just a 2.9 month supply on the market, according to the National Association of Realtors.

New home construction fell 1.4% in December compared to November and was down nearly 22% from a year ago, according to the Census Bureau. What's more, fewer sellers are putting homes on the market, adding to the supply crunch.

"Part of the reason sellers aren't listing is high interest rates," said Karen Schneidman, associate broker at Berkshire Hathaway HomeServices in New York City. "They don't want to trade in their 3% interest rate for a 6% interest rate."

New listings fell 18% year over year during the four weeks ending Jan. 22, according to RedFin. That's the smallest decrease in almost three months, but much steeper than the 8% decline a year ago.

"Interest rates in the 5% to 6% range aren't enough to offset the bigger problem of limited supply," Richard Nagle, a real estate agent with RE-MAX Elite in Monmouth Beach, New Jersey, told ABC News. "It's still a sellers market. It was a "rabid" seller's market in 2020 and 2021. Now, it's just a seller's market."

"Until we see more inventory, I don't see how prices come down," said Nagle. "Bidding wars are still happening for properties that are priced right and have that HDTV, turn-key look. They're getting a lot of attention from buyers."

Even with elevated home prices, experts say lower mortgage rates should help ease the affordability squeeze for millions of Americans. Mortgage rates have been trending lower in anticipation of the Federal Reserve nearing the end of its interest rate hiking campaign to rein in inflation.

"Through the course of 2023, we expect mortgage rates to end the year closer to 5% rather than the 6% where they are today," said Mike Fratantoni, chief economist at Mortgage Bankers Association.

Still, experts agree that waiting to time the market can be counterproductive.

"This is your home after all, and if you want to buy or sell you should do that when the time is right for you," said Schneidman. "That said, I had a client who bought low in 2003 and sold high in 2008 just before the market crash and saw his property appreciate by 150% in five years. So, while timing the market may not be urban legend, it is a unicorn nonetheless."