The Top Tax Question on Google Will Surprise You

Do you know the answer to the No. 1 tax question web users are asking?

— -- With more people filing their taxes electronically, many turn to the web to answer their basic tax questions -- and Google has kept track of the most frequently asked ones.

More than 90 million people have already filed individual income tax returns as of March 27, slightly lower than the number of people at that point last year, with twelve more days until the tax man cometh.

Google made a list of the top tax questions since Jan. 1 of this year and the states where people had the most tax questions:

1. What is income tax?

Google's first search result provides a definition of income tax: (noun) tax levied by a government directly on income, especially an annual tax on personal income.

2. When does tax season start 2015?

Tax season for paper and electronically filed returns opened on January 20, 2015.

3. When is tax day?

It's Wednesday, April 15.

4. Where is my refund?

Visit the IRS page irs.gov/Refunds about 24 hours after the IRS has received your e-filed tax return or four weeks after you mailed your paper return.

5. How to calculate income tax?

The first result provides a link to a free H&R Block calculator estimator.

6. What is state income tax?

Google's first search result is a preview of Wikipedia's answer. Essentially, it's a tax levied on your income by the state in which you typically work. But not all states assess income tax, including Alaska, Florida, Texas and Nevada.

7. What states do not have income tax?

Feeling the urge to movie? Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming don't assess state income taxes.

8. How to calculate federal income tax?

Google refers taxpayers to IRS' Withholding Calculator, which suggests using your most recent stubs and income tax return.

9. What is adjusted gross income?

Again, Wikipedia's definition is a top result. TurboTax, another top result, has a similar definition: your AGI is your total income you report that's subject to income tax, before you take exemptions and deductions.

10. Who has to file income tax?

Not everyone who had an income last year has to file taxes, depending on your income, age and filing status, though many professionals recommend you do so. A loose chart on efile.com is one of Google's top search results, which shows a single person under 65 has a minimum income requirement of $10,150.

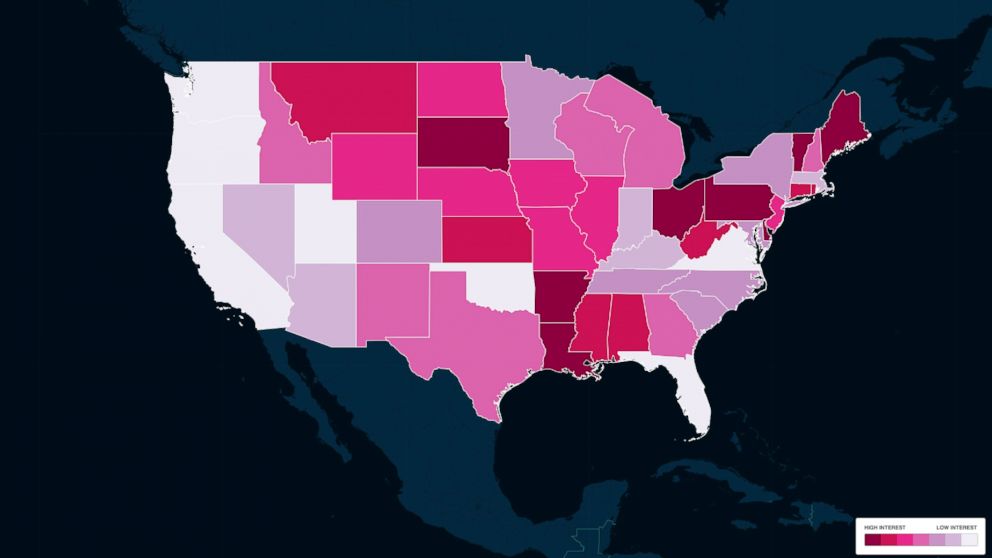

Top States Searching Tax-Related Terms:

1. Maine

2. Ohio

3. Arkansas

4. Delaware

5. Louisiana

6. South Dakota

7. Vermont

8. Pennsylvania

9. Montana

10. Mississippi