Luxury hotels benefited from PPP loans. So did the investment trusts that own them

The PPP has been billed as a lifeline for small and independent businesses.

The Ritz-Carlton on Peachtree Street in Atlanta’s downtown boasts well-appointed suites with skyline views, chic amenities and a cocktail bar that slings $17 juleps. Before the coronavirus pandemic forced the hotel to close its doors, a standard room could go for between $440 and $650 a night.

To offset the financial impact of the virus, the hotel applied for a potentially forgivable loan through the federal government’s Paycheck Protection Program (PPP), which has been billed as a lifeline for small and independent businesses. Though it is neither small nor independent, Atlanta Ritz-Carlton received over $3 million from the program, according to the Securities and Exchange Commission. The company that owns the property, a real estate investment trust (REIT) called Ashford Hospitality Trust, also owns 116 other hotels that applied for loans through the same program. So far, filings show Ashford Hospitality Trust has received $38 million altogether. And the company that oversees Ashford Hospitality Trust -- Ashford Inc. -- also applied for loans through PPP. It was granted more than $13 million.

Established by the sweeping $2.2 trillion CARES Act, the PPP was intended to provide relief to a wide swath of businesses with 500 or fewer employees, and relaxes that size restriction for applicants in the hotel and restaurant industries. Many say those broad terms have allowed much of the $349 billion already allocated through the program to wind up in the coffers of big companies with access to other financial support. But another vague stipulation—that applicants certify in good faith that “current economic uncertainty makes the loan necessary to support your ongoing operations”—could mean some recipients are in for a day of reckoning.

The devil in the lack of detail

The Trump administration has touted the PPP as a success for small businesses.

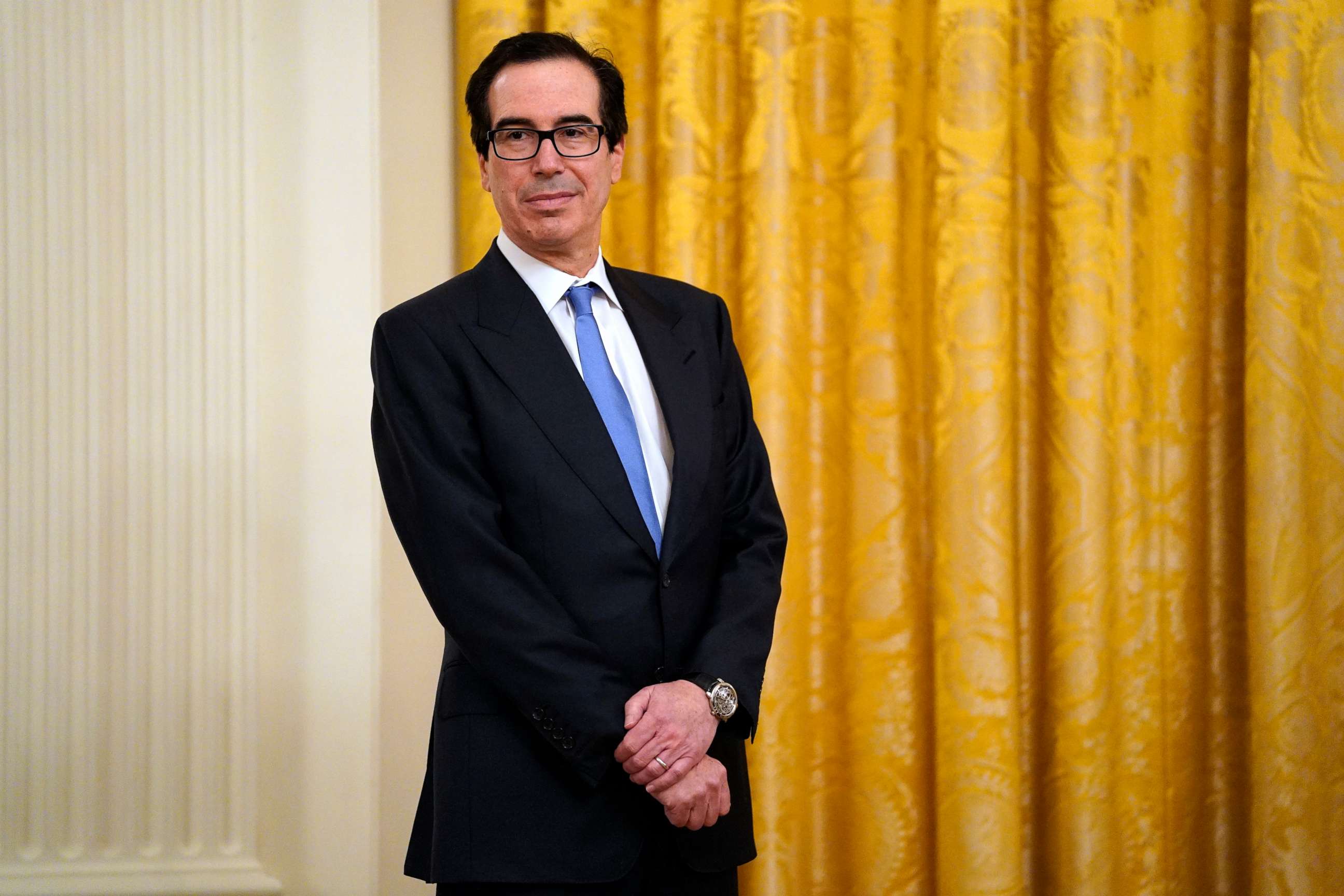

“The vast majority of these loans—74% of them—were for under $150,000, demonstrating the accessibility of this program to even the smallest of small businesses,” Treasury Secretary Steven Mnuchin said in a joint statement with the Small Business Administration.

That statistic doesn’t tell the entire story. Large, publicly traded companies can be comprised of a smattering of smaller entities. In some cases, these holdings can qualify for PPP loans. And because the entity is smaller and the maximum size of a PPP loan is based off of monthly payroll costs, the total is lower. But they can add up quickly. For instance, Ashford Hospitality has applied for 13 loans for less than $150,000 through the LLCs linked to its various properties.

Moreover, the Small Business Administration typically doesn’t loan money to “passive companies,” or businesses that make money from rental property (as REITs do) or other investments instead of selling a product or service. The SBA, however, makes a narrow exception for certain passive companies that lease to eligible small businesses.

In the case of the PPP, lobbying groups have pushed the Treasury Department and the SBA to confirm that REITs are eligible for the loans, but the uncertainty has opened the door for both the trusts and their holdings to apply. And, unlike other outlets for assistance established by the CARES Act, PPP funding comes with fewer strings attached.

“We think that the PPP will be of interest to our REIT clients because it should be a resource for tenants and borrowers to obtain funding that is expressly designed to be used to pay rent and debt service," the law firm Clifford Chance said in a briefing last month. "Additionally, REITs may wish to use funding under the PPP for their own payroll expenses. Although the amount of a loan, under the PPP, is limited to $10 million, the PPP does not subject borrowers under the program to the restrictions on dividends, compensation and share buybacks that will apply to recipients of funding under the Federal Reserve programs.”

What is clear is that while the hotels under Ashford Inc.’s umbrella received PPP loans, the company also applied for loans on behalf of 10 of its LLCs that are not directly linked to those properties. The LLCs include hotel consulting and management services, real estate advisory services, a software company and a number of entities without clearly outlined business functions.

Ashford Inc. says it has carefully managed its applications to avoid “double dipping.” But it is still in violation of the PPP's purpose, according to Dennis Kelleher, the president and CEO of Better Markets, a nonprofit founded in the wake of the 2008 financial crisis that promotes tighter regulation on Wall Street.

“Taxpayer money is not intended for the already rich private equity sponsors, hedge fund titans and REIT managers with Park Avenue penthouses and Greenwich, Connecticut, mansions,” Kelleher said. “There is no similarity between them and the suffering of small businesses on Main Street. It's not comparing apples to apples. It’s comparing an apple to an elephant."

But in the case of REITs, it’s desperation—not greed—that has pushed them into pursuing PPP loans, said Chip Rogers, the CEO and president of the American Hotels & Lodging Association, a hospitality industry trade group.

“Everyone is in survival mode right now,” Rogers said. “They’re doing anything they possibly can to stay afloat."

Rogers also argued that the size and type of company that receives the loan ultimately doesn’t make a substantial difference.

“The resources are being used to do one of two things—that is pay employees or keep the businesses afloat so that the employees have a job at the end of the day,” Rogers said.

What comes next?

When Congress approved $310 billion more in funding for the PPP, the SBA released updated guidance saying borrowers must assess “their ability to access other sources of liquidity,” adding, “It is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification.”

Kelleher agrees. “I find it hard to believe that any actual financial analysis of these companies could genuinely satisfy a certification of necessity,” he said.

Still, Ashford Inc. insists the PPP loans were a last resort.

“Although our companies are publicly listed, they do not have access to this volume of emergency funding from the capital markets that we believe we need during this crisis due to their relatively small market capitalizations,” Ashford Inc. said in a statement to ABC News.

The company also noted that many other hotel owners, as well as other public companies and private equity groups, have applied for assistance through PPP.

The SBA has now explicitly prohibited private equity firms from participating in the program.

ABC News reached out to more than a dozen publicly traded REITs to inquire if they or any of their holdings applied for PPP loans. Although some of the companies own hotels that received loans through the program, only one REIT responded to ABC’s request—Chatham Lodging Trust. The company confirmed it had applied for loans for all 40 of its properties but the money would not cover any of the operational costs associated with the REIT itself.

Last month, before the PPP was established, Chatham Lodging Trust detailed other steps it was taking to mitigate the effects of the COVID-19 pandemic in a release to its investors, noting it would preserve approximately $64 million on an annual basis by suspending dividends and taking other steps to increase its cash liquidity position to approximately $55 million.

The SBA is allowing borrowers to return funds which may have not been “necessary" to sustain their businesses by May 7 without penalty. Mnuchin also announced Tuesday that the government will audit any business that takes out a loan over $2 million before it can be forgiven.

Juleanna Glover, a public affair adviser to corporations and board member of the Biden Policy Institute, said that audit may be just one of the probes companies will face.

“This is going to be one of the most thoroughly overseen programs in the coming months because it is so ripe for exploitation,” Glover said. “It’ll be federal prosecutions, it'll be congressional investigations and it will be national and local media.”

But Kelleher says that the delay in oversight will continue to jeopardize the intended recipients of PPP loans, regardless of how many times Congress re-ups funding.

“It's always going to be limited,” Kelleher said. “Therefore, every dollar that's pocketed by an undeserving financier is literally taken out of the pocket of the Main Street small business in need.”

After public backlash, a number of big businesses who received PPP loans said they will return the funds. According to data analytics from FactSquared, 251 public companies have been approved for loans through the program; 15 have announced they will give the money back. Ashford Inc. is not one of them. The company said in a statement, “We plan to keep all funds received under the PPP ... any funds for which we are determined to be not qualified will be returned according to the requirements of the program.”

But for now, Ashford Inc. and its subsidiaries are seeking more money from the government stimulus program. Its latest SEC filings show loan applications for more than $50 million.