How to Make Sense of Your Paycheck

Here are five things that confuse people the most about paychecks.

— -- intro:

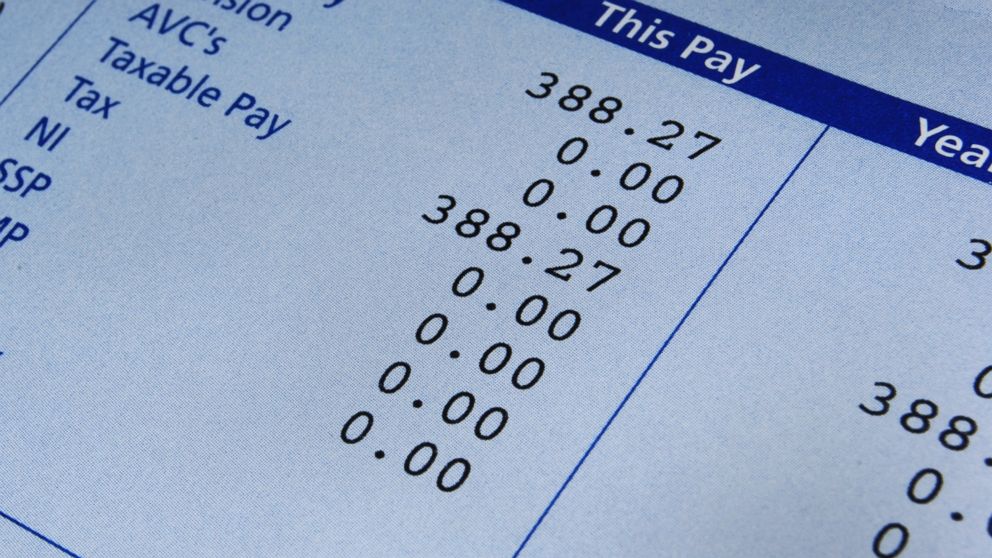

Remember that first paycheck? That surprise when you discovered you weren’t going to take home your entire earnings? The confusion over all those boxes and codes? FICA? FUTA? What the heck does that mean?

Paystubs can be puzzling. As CIO of a Payce Inc., a payroll company serving employers all over the country, Josh Lindenmuth understands that confusion. “We get a lot of questions from our clients about pay stubs, many of which are questions that they were asked by their employees,” he says. He polled his colleagues to find out the top five items that stump employees, and here they are:

quicklist:title: Retirement Plan Tax Deductionstext:

If you have a 401(k), 403(b) or similar retirement plan, the tax deductibility of that contribution can get confusing. “Most employees don’t realize that 401(k)s, 403(b)s, and many other deductions are not taxable for some tax types, and taxable for others,” Lindenmuth says. “For example, a 401(k) deduction is not taxable for federal withholding, is taxable for Social Security and Medicare, and is not taxable for most states.”

More From Credit.com: Are You Financially Ready for Retirement?

quicklist:title: More Taxestext:

Yes, you know there will be taxes taken out of your paycheck. But do you realize how many? “The average paycheck has six different employee taxes,” Lindenmuth points out. “State disability, local service taxes, city taxes, county, OASDI and more.” These are often abbreviated, and there is no single standard for those abbreviations. He gives the example of federal withholding, which could appear as “FIT, FITW, FWH, FED or any other variant.”

More From Credit.com: A Quick Guide to Common Tax Deductions

quicklist:title: Tipstext:

If you work in the service industry where some or all of your income is based on tips, you may find the way they are reported varies from employer to employer. “Some companies show tips as both an earning and an after-tax deduction, which is done to make the tax calculations simpler,” says Lindenmuth, “but this leaves many employees befuddled.” He says his company lists them as “a taxable memo item,” and still others may list cash and credit card tips separately.

It is important to understand how tips are reported, not only so you correctly file your tax returns, but also if you are planning to apply for a mortgage or another major loan. Here’s how tips affect your ability to get a mortgage.

quicklist:title: Leave Paytext:

Do you earn paid vacation, sick or personal days? Of course you’ll want to keep track of how much time you’ve earned and have available. But sometimes that’s easier said than done. Lindenmuth explains:

“They’ll often include a lot of other details, and the week-by-week changes for the leave pay figures on a pay stub are often difficult to comprehend. That’s because hours available doesn’t always change by year, but rather by a combination of the employee’s tenure, hire date, hours accrued (earned) throughout the year, and any leave pay carried over from the prior year. Since leave pays can reset at any point in the year based on the company’s policy, employees are often left scratching their heads and just assume it’s correct. To help employees figure out how the leave pay is calculated, some companies include figures such as beginning balance (amount available after the last reset), hours accrued (hours earned since last reset), and hours taken (total number of hours taken since the last reset).”

quicklist:title: Group Term Life Deductiontext:

Does your employer pay for employee life insurance? If so, you may see a deduction for this on your pay stub. Your reaction may be “Why? They are paying for it.” This deduction will be for the taxes on that benefit, rather than for premiums. Employers usually pay for one dollar of coverage for each dollar in salary. The first $50,000 in coverage is not taxable, but any amount over that will be. For example, if your salary is $75,000 and you receive $75,000 in employer paid life insurance, you will be taxed on $25,000 of it. ($75,000 – $50,000 = $25,000.) “This shows up on the pay stub as a GTL deduction, which is often very confusing,” Lindenmuth says.

More From Credit.com: How to Read Your Paycheck: Understanding Your Pay Stub

Clearing Up Confusion

What should you do if you don’t understand something on your pay stub? “Ask your supervisors or payroll personnel,” advises Lindenmuth. He says that’s especially important when you first start working for a company or if a new tax or deduction appears on your pay stub. “In some cases, the payroll deduction or tax in question may have been added in error – asking right away ensures that the problem is fixed before it can have tax implications for the employee or their employer,” he notes.

Any opinions expressed in this column are solely those of the author.