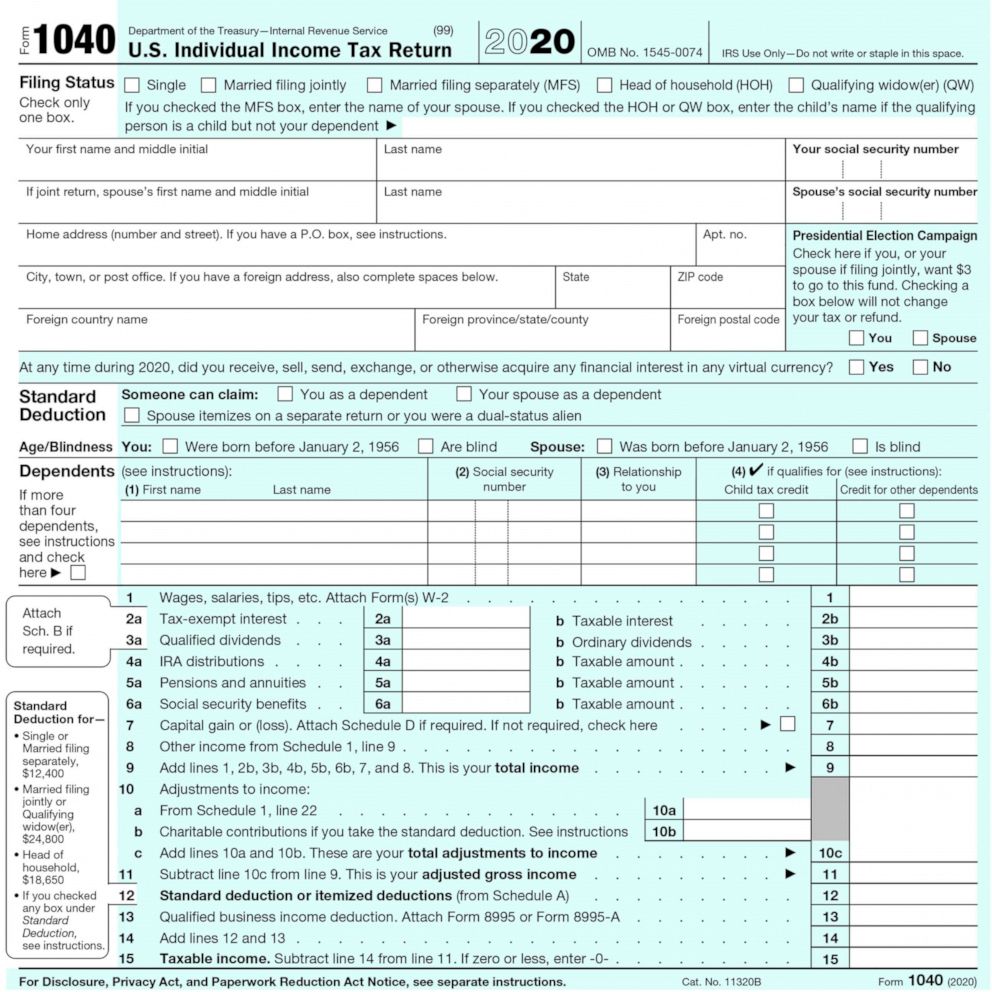

IRS delays tax filing deadline to May 17 because of COVID-related changes

The due date will be automatically extended and no special forms are needed.

The IRS said Wednesday it is delaying the April 15 tax filing deadline to May 17 giving taxpayers more time to prepare their filings amid the slew of pandemic-related tax changes.

The Treasury Department and the IRS said "the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021."

This will happen automatically, and individuals don’t need to file any forms or contact the IRS, the agency said in a statement.

"Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed," the IRS said.

These changes don’t apply to state tax returns and payments, the IRS noted.

The relief does not apply to estimated tax payments that are still due on April 15, 2021, the IRS said.

"This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities," IRS Commissioner Chuck Rettig said in a news release. "Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to," he said.

Rettig was set to testify Thursday before the House Ways and Means Committee about the 2021 filing season.

“This extension is absolutely necessary to give Americans some needed flexibility in a time of unprecedented crisis," Reps. Richard Neal and Bill Pascrell said in a joint statement.

"Under titanic stress and strain, American taxpayers and tax preparers must have more time to file tax returns. And the IRS itself started the filing season late, continues to be behind schedule, and now must implement changes from the American Rescue Plan.

"We are gratified that the IRS has recognized the need and heeded our calls for additional time, and while we are pleased with this 30-day extension, we will continue to monitor developments during this hectic filing season," they said.