What is the Federal Reserve and how do interest rates affect me?

What is the Federal Reserve and how do interest rates affect me?

One of President Trump favorite punching bags is the Federal Reserve and its current chair Jerome Hayden “Jay” Powell, whom Trump nominated last year.

The president has consistently gone after Powell and the central bank, blaming it for the recent tumbles in the stock market and even the planned closure of seven General Motors plants around the world.

“I’m doing deals, and I’m not being accommodated by the Fed,” Trump told The Washington Post on Nov. 27. “They’re making a mistake because I have a gut, and my gut tells me more sometimes than anybody else’s brain can ever tell me.”

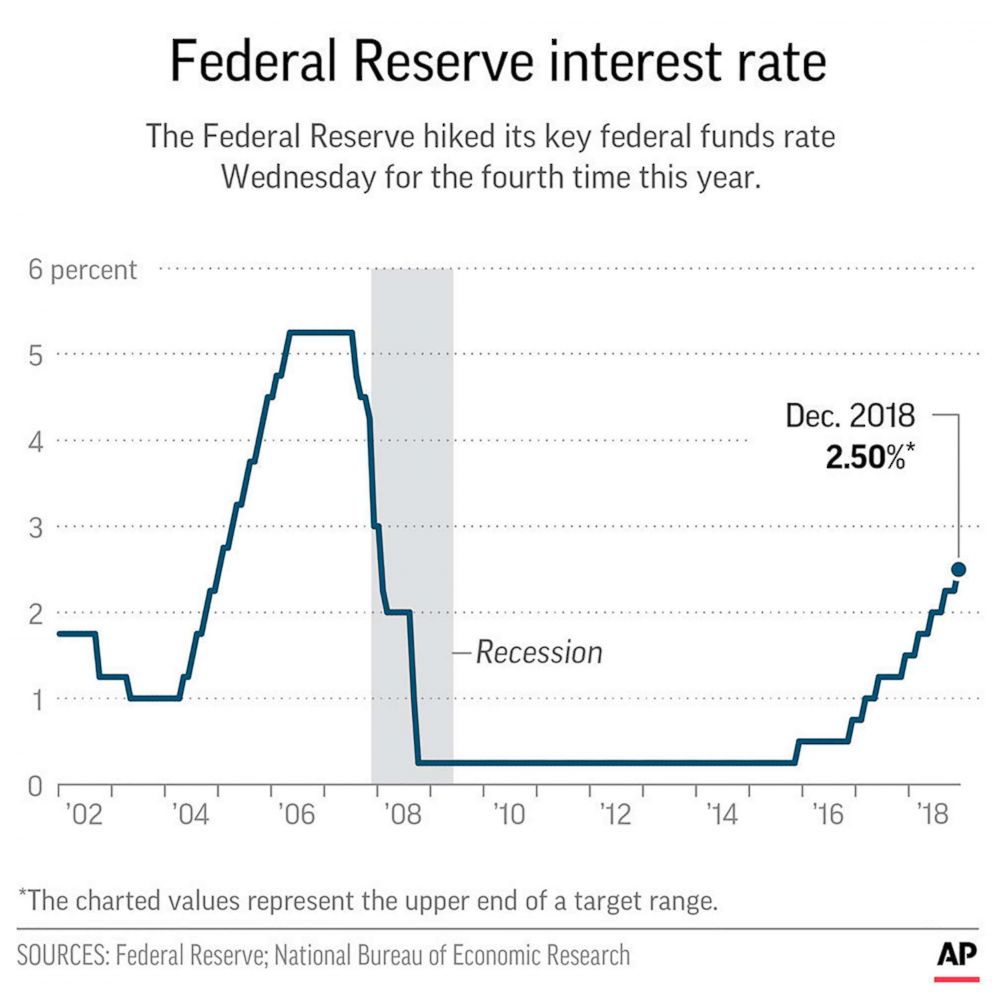

On Wednesday, the Fed announced it would hold interest rates steady, potentially signaling a break from its policy of raising rates from 2015.

The last rate hike was on Dec. 19, when the Fed raised rates 25 basis points or 0.25 percent to 2.25 to 2.5 percent. It was the fourth rate hike in 2019, and the ninth since 2015, when the Fed started raising rates after the recession. Prior to the December 2015 rate increase, the last time the Fed raised rates was in 2006, before the 2007 financial crisis.

What's the Fed?

The Federal Reserve is the central bank of the U.S. It's the institution that sets monetary policy.

What's monetary policy?

Monetary policy controls the supply of money and sets the level of short-term interest rates to keep the economy on the right track.

What most people talk about when they talk about interest rates is how cheap or how expensive money is. In effect, this means how expensive loans are. When interest rates are high, financing (borrowing money), such as mortgages, car loans and credit card debt payments become higher, and money is "more expensive." When interest rates are lower, it's cheaper to borrow money.

Why raise interest rates?

Several reasons. If the economy were to head into recession, the Fed may want to lower rates to spur growth. If rates are already very low, that's hard to do.

"The concern of the Fed is that if the economy is running too hot, that would create too much upward pressure on prices, and that would create inflation," Timothy Duy, a central back expert and professor at the University of Oregon told ABC News. Duy is the author of the influential "Fed Watch" blog. "It is trying to balance the pace of economic activity with the pace of inflation."

AS Duy explained, the Fed is watching inflation, or when the cost of goods rises. Consumer purchasing power decreases as a result.

Higher interest rates also help people who have savings accounts, so that they will have higher interest payments. This often affects people who have retired or are living on a fixed income.

Despite the headlines and stock market responses to each Fed move, the central bank works with a long term view of the economy.

To understand the actions of the Fed, "it's not about any one move," Duy said. "It's the totality."