Real Money: 4 Tips to Help Get You Out of Debt

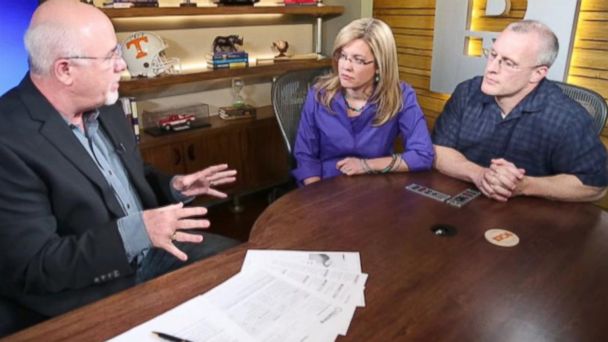

ABC News' Linzie Janis and Eric Noll report:

Ambre and Eddie Maze of Nashville, Tennessee, are drowning in debt and say they're so worried about their financial situation that Eddie, a lawyer, took a second job as a taxi driver to keep up with the bills.

"We just seem to always be getting in a pinch," said Eddie, 42.

ABC News

Related: Tips to avoid paying high bank and credit card fees.

The Mazes owe $112,000 in student loans, $8,000 in car payments, $2,000 on their credit cards, and $500 in medical bills, on top of their home mortgage.

"When we got married, we actually came into the marriage with debt," Eddie told ABC News. "We were doing well, making a dent, but then we had kids!"

ABC News teamed up with powerhouse finance guru Dave Ramsey to help the Mazes and others learn how to overcome mountains of debt.

Read the following tips:

Tip 1: Get your finances in order using a new, free service called Check and stop the bleeding. According to www.manilla.com, Americans rack up more than $22 billion a year in late fees and penalties.

The Check app tracks bills to determine their due dates and allows users to schedule automatic payments, avoiding late fees.

Check also watches credit cards, bank accounts, investments and bills all at once so users know exactly how much spending money they have each month.

Tip 2: Stop borrowing by cutting those credit cards.

Ramsey suggested that those in debt perform what he dubs a "plas-ectomy" - essentially chopping up their credit cards so they can't, and won't, get into more debt. According to www.creditcards.com, Americans each have an average of two credit cards.

Tip 3: Make a written family budget - one in three Americans does this.

Ramsey - who preaches a no-nonsense approach to sold-out arenas, his 1 million Facebook and Twitter fans and more than 8 million radio show listeners - said a solid family budget could work to help families get out of debt.

"When you agree on your budget, you pinky swear and spit shake, this is a contract between the two of you," Ramsey told ABC News.

Ramsey also suggested reevaluating these common spending areas for the family budget:

- food

- cell phone plans

- car, home, life insurance

- extra activities likes sports, dance classes, vacations and movies

For those in debt, Ramsey recommended streamlining the budget to get rid of any extraneous expenses. He said that seeing in black and white helped identify trouble spots. In the Mazes' case, they found by tweaking their cell phone plan and cutting down on restaurants and after school classes could save them $2,100 a year.

Tip 4 (and the Magic Rule): Pay off debt using what Ramsey calls "the snowball method."

"We're going to list our debts smallest to largest, pay minimum payments on everything but the little one. Attack that little one with a vengeance," Ramsey said. "You knock that little one out. When that little one is gone, it gives you some energy because you go, for the first time ever, 'I'm happening to my money. All the stuff's not happening to me.'"

If paying off the smallest debt before the most expensive debt sounds unorthodox, that's because it is.

"It's counter-intuitive for those of us who are math nerds," Ramsey said. "I say pay off the smallest first because this is so behavior oriented. … You got to have a light at the end of the tunnel that's not an oncoming train."

If the Mazes stick to the plan, Ramsey said they could pay off their $120,000 of debt in 36 months.

"Over the years I've learned it's more about hope and believing you're going to win so you keep in the game than it is about actual mathematics," said Ramsey. "You probably won't see the inside of a restaurant for a while unless you're working there. You're probably not going on vacation for a while. You have to clean this mess up, because if you don't bust into this with tremendous passion, it doesn't crack open. There's no middle ground."