401(k) Fees May Cut 30 Pct From Retirement Balance

American workers who don't think twice about their employer-sponsored 401(k) plans may be surprised to learn that fees can cut their retirement savings by 30 percent over a lifetime.

A household with two people earning the median income of their age group from 25 to 65 will pay an average of $154,794 in 401(k) fees and lost returns, according to a report from progressive, non-partisan public policy research group, Demos, based in New York.

The $154,794 is 30.3 percent of that household's retirement balance of $509,644 that is lost to fees.

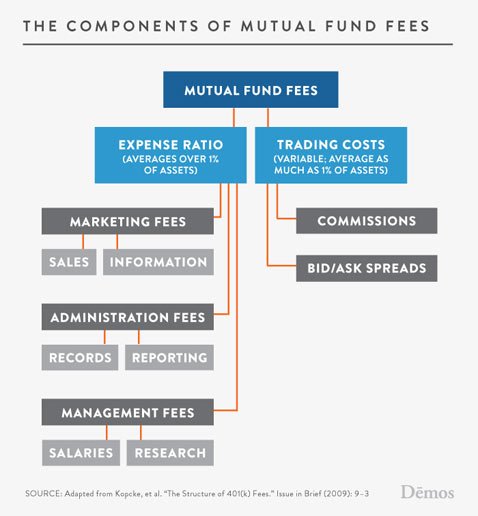

(Image credit: Demos)

The median 401(k) balance was a scant $23,000 at the end of the first quarter this year among Fidelity Investments' 11.8 million accounts.

The higher your income, the greater the absolute value you pay in fees.

A dual-earning household in which each partner earns an income greater than three-quarters of Americans each year over their lifetime can expect to pay as much as $277,969.

Robert Hiltonsmith, policy analyst at Demos, said the most surprising finding was how much of a retirement balance can be lost to fees.

"I knew it was going to be a lot I didn't realize it was going to be more than 30 percent of what your retirement nest egg would have been," he said.

The mutual fund industry provides a different picture.

After surveying 525 401(k) plans of all types and sizes, the Investment Company Institute, a trade group, finds that the median 401(k) plan fees for a couple would be $496 a year-"a small fraction of the projection that Demos made without surveying any plans at all," according to Brian Reid, ICI Chief Economist.

The Los Angeles Times reports that would cost the average dual-income household under $20,000 while working over four decades.

But Hiltonsmith said the institute does not take into account trading fees, which represent nearly half of fees paid in Demos' calculations.

Second, the household in Demos' model makes consistent, increasing contributions each year, and never withdraws or cashes out their balance due to a life trauma or shock, Hiltonsmith said.

"Most households, however, don't have the economic or job security for this to be the case, and aren't able to do one of both of these things," he said.

Hiltonsmith said the institute uses the median retirement balance, which is low because of the economic realities faced by most households trying to save for retirement.

The 30.3 percent figure that Demos discovered doesn't vary based on household contributions or balances.

"And that percentage bite is, I think, the number to focus on," Hiltonsmith said.

Workers with 401(k) funds can act to minimize the fees for their accounts in at least three steps.

1. Workers should learn what their fund's expense-ratio is.

An expense ratio is a mutual fund's fixed costs, such as administrative and marketing fees divided by the total assets of the mutual fund.

In the 401(k) funds available to Demos employees, the expense-ratios range from 0.70 to 1.3.

You can find most funds' expense-ratios and compare funds on sites like Morningstar.com and Brightscope.com. Starting July 1, 401(k) providers will be required to disclose fees and expenses according to a rule first approved by the Employee Benefits Security Administration's rule in October 2010.

Higher fees do not guarantee a higher return.

2. You can ask a financial advisor about shifting their money into lower-cost funds.

Actively-traded funds, which aim to maximize returns by rapidly buying and selling assets, incur much higher trading costs than passive funds, such as index funds. The latter invests in a set diversified portfolio or in a fixed mix of assets.

3. Workers can ask their employer about having lower-cost 401(k) options available or switching providers.

Elisabeth Leamy ABC News' consumer correspondent, said that if banding together with your co-workers and pushing for better choices still fails, workers should make the minimum contribution to get the company match and put the rest of your savings into a low-fee IRA.

"I think the major point that we want a lot of people to take away from this is that these high fees in the system are part of the greater shifting of retirement risks and costs that have happened in the past 30 years," Hiltonsmith said. "They shifted from the shared responsibility of employers and employees to solely on the backs of employees."

Hiltonsmith said 401(k) funds should not be the primary place to supplement a worker's Social Security benefits.

"The system isn't suitable to be the main place for workers to save for retirement," he said of 401(k) funds. "It's not safe and it's not low cost."

(Image credit: Demos)