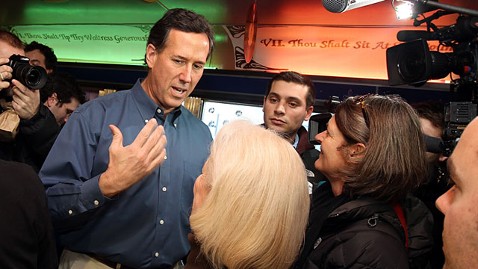

On Taxes, Populist Santorum Contrasts With Romney

If there's any doubt that insurgent GOP presidential candidate Rick Santorum is gunning for the mantle of blue-collar conservative, just take a gander at his tax plan: Families with children would receive triple the current tax exemption, and companies that manufacture goods in America would not be taxed at all.

If there's any doubt that insurgent GOP presidential candidate Rick Santorum is gunning for the mantle of blue-collar conservative, just take a gander at his tax plan: Families with children would receive triple the current tax exemption, and companies that manufacture goods in America would not be taxed at all.

The populist proposals, which set him apart from his rivals, are key components of Santorum's "faith, family and freedom" agenda that resonated in Iowa and which he now hopes will draw blue-collar voter support in New Hampshire.

"I believe in cutting taxes. I believe in balancing budgets. … But I also believe we as Republicans have to look at those who are not doing well in our society by just cutting taxes and balancing budgets," Santorum said Tuesday after coming within eight votes of front-runner Mitt Romney in the Iowa caucus.

Santorum wants to overhaul the tax code to create two income tax rates - 10 percent and 28 percent - while tripling the current exemption per child and eliminating the so-called marriage tax penalty paid by many dual-wage earning couples.

"That's a very big deal," said Howard Gleckman, a senior fellow at the nonpartisan Tax Policy Center.

"Most of the other Republican candidates are either scaling back these exemptions from what they are now, or they leave them alone. But Santorum is actually being very generous to them on the tax side," he said.

Santorum also believes eliminating taxes on U.S. manufacturers would dramatically spur economic growth and create "millions" of jobs. He also favors expanding the research and development tax credit from 14 to 20 percent and allowing all companies to fully expense investments in new equipment.

"People say you are only doing it for political purposes, and I say no I'm doing it because that's where I grew up," Santorum told a crowd in New Hampshire Thursday. "I grew up in a manufacturing town."

"You can sort of see a pattern," said Gleckman. "What Santorum is thinking about are less educated, more blue-collar larger families with kids. And that sort of fits with Santorum's whole narrative, so he is in fact playing to them."

Romney does not offer any specific tax benefits for manufacturers or families in his plan. On individual income tax rates, he favors maintaining the status quo in the short term with promises of lower tax rates in the future.

But what the Romney tax plan does not lack are "urgent" and "immediate" rate cuts for corporations across the board.

Romney proposes cutting the business tax rate from 35 to 25 percent and temporarily extending the investment tax credit and expensing allowance. He also favors a tax holiday for repatriation of foreign profits with an eventual elimination of the existing system.

An analysis of Romney's tax plan released by the nonpartisan Tax Policy Center Thursday noted that while his is more modest than the proposals of Santorum and the other candidates, it would significantly benefit the nation's highest income earners, particularly those with ties to corporate profits, over families in the middle class.

Families earning between $50,000 and $75,000 a year, for example, would receive an average tax cut of $1,800, or 2.7 percent, under Romney's plan.

Those raking in more than $1 million would average $290,000 in savings, a 9.3 percent cut, compared with current law, according to TPC.

The Center has not yet conducted a formal analysis of the Santorum plan.

Experts on both sides of the aisle have leveled plenty of criticism on each candidate's tax plan, though there is arguably more worry about what Santorum's plan would do to the deficit because of the expanded child exemptions and special treatment for manufacturers.

"From an economics point of view, Romney's got the more free-market upper hand as far as I'm concerned," said Chris Edwards of the CATO Institute.

Both Edwards and Gleckman cautioned that the tax cuts proposed by the GOP candidates will require dramatic, concurrent spending cuts to social programs to make up the difference. Neither candidate has fully or specifically articulated details of those cuts.

And that's what worries Edwards.

Santorum's two-tier individual income tax plan is "exactly right," he said. But "if you're going to propose a two rate plan, you're going to need to get rid of some of the hardest deductions like mortgage interest, but he wants to expand some of them. You can't have it both ways."

As for Santorum's proposed tax rate for manufacturers: "That's terrible policy. Why should Microsoft have to pay a high rate by Intel, who manufactures chips?" Edwards said.

Former House Speaker Newt Gingrich and Texas Gov. Rick Perry both favor giving taxpayers a choice of filing under the current system or paying a flat rate. They would both also trim the corporate tax rate, Gingrich to 12.5 percent and Perry to 20 percent.